On December 31, China’s copper futures market experienced short-term volatility.

The Shanghai copper futures main contract saw a slight pullback during the session and closed at USD 12,500 per metric ton, posting an intraday gain of 0.84%

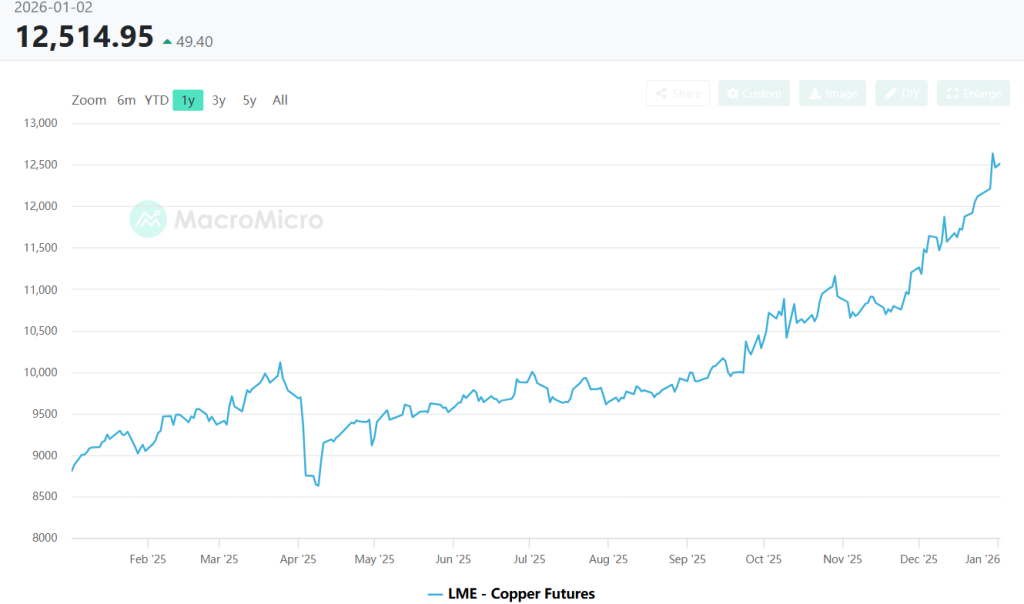

From a longer-term perspective, supported by tight supply on the mining side and improving expectations for global demand, international copper prices have shown a broadly volatile upward trend over the course of the year.

The price center has continued to move higher, with copper remaining in a historically elevated range.

From below USD 8,600 per metric ton at the beginning of the year to a stable range of USD 11,600–12,000per metric ton in the fourth quarter, LME copper prices have risen by more than 30% over the year.

More importantly, this rally is not driven by short-term market sentiment, but represents a “platform-style price uplift” formed against the backdrop of a tight supply–demand balance

For the connector industry, where copper is one of the core base materials, fluctuations in copper prices are never merely a raw material issue.

Instead, they represent a systemic variable that directly affects cost pass-through, product pricing, material selection strategies, and ultimately the survival and competitiveness of enterprises.

Against the backdrop of copper prices becoming the new normal at elevated levels, the connector industry is being forced into a moment of divergence — a real test of who can “absorb the pressure” and who cannot.

2025 Copper Price Trend Review

Looking at the full-year performance, LME copper prices in 2025 exhibited a classic pattern of volatile upward movement with a continuously rising price center.

At the beginning of the year, copper prices hovered around USD 8,600 per metric ton. Driven by multiple factors, prices moved higher amid fluctuations and, by December, stabilized within the USD 12,000–12500 per metric ton range.

The characteristics of a high-level price platform became increasingly evident.

From a structural perspective, copper prices went through three major phases over the year:

Phase One (February–March): The first rapid upswing.

Copper prices surged quickly from around USD 8,800 per metric ton to a peak near USD 9,800/mt, marking the first clear breakout of the year.

This rally was mainly driven by supply-side disruptions at South American mines, declining global inventories, and a temporary weakening of the U.S. dollar, which brought tightness on the supply side into sharper focus.

Phase Two (Mid-April): Sharp correction and rapid recovery.

In mid-April, copper prices briefly fell sharply from around USD 9,700 to approximately USD 8,700 per metric ton, marking the largest pullback of the year.

The decline was primarily triggered by weaker macroeconomic expectations and profit-taking by investors.

However, the correction proved short-lived. Starting in May, prices quickly rebounded above USD 9,000/mt, indicating that the tight supply–demand balance remained fundamentally intact.

Phase Three (Since August): Establishment of the main upward trend.

In the second half of the year, copper prices began a stepwise ascent, surpassing the USD 10,000 per metric ton milestone in October and maintaining high-level fluctuations throughout the fourth quarter.

The drivers of this rally clearly shifted toward structural demand, including the accelerated construction of AI servers and data centers, concentrated stocking by the new energy vehicle and energy storage sectors, while financial market bullish forces also regained momentum

Overall, the combination of a sustained upward trend and a high-level platform in the fourth quarter represents the most distinctive feature of copper prices in 2025.

This pattern has also preemptively imposed a “hard constraint” on cost escalation for downstream processing and manufacturing industries.

Costs Are No Longer “Easily Absorbed”

How Are Rising Copper Prices Transmitted to the Connector Industry?

In the connector industry supply chain, copper is not only a key conductor material but also the most significant and unavoidable component of cost structure.

Fluctuations in copper prices are now being transmitted downstream in a more direct and rigid manner.

Rising Material Costs Force Price Increases

The sustained high level of copper prices has significantly amplified material cost pressure for connector manufacturers.

This is particularly evident in products with high copper usage, such as terminals, wire harnesses, and high-speed connectors, where cost elasticity has been noticeably compressed

On December 5, 2025, global connector giant TE Connectivity issued a price adjustment notice to its worldwide channels, explicitly stating that, “due to inflation and rising prices of metal raw materials, among other factors,” it would implement price increases across all regions and product lines.

This move is widely regarded in the industry as a clear signal that cost pressures are being formally transmitted to end-product pricing. For leading enterprises, price increases can still be absorbed through brand strength, technology advantages, and strong customer loyalty.

However, for small and mid-sized connector manufacturers, rising copper prices mean gross margins are quickly eroded, and companies with limited pricing power will face pressure first.

End-Product Costs Rise Passively, Squeezing Negotiation Leverage

From the demand side, rising copper prices do not immediately curb the rigid demand for connectors, but they amplify cost pressures layer by layer through OEMs and system integrators.

In sectors such as new energy vehicles, data centers, and industrial automation, connectors are usually not a visibly high-cost item in the overall system, yet they remain irreplaceable critical components.

As raw material costs continue to climb, end-product manufacturers often offset their expenses by compressing supplier margins, making the pricing environment for connector companies increasingly challenging.

Divergence Accelerates: Cost Management Becomes a “Lifeline”

The normalization of elevated copper prices has evolved from a short-term disruption into a key catalyst reshaping the connector industry, accelerating market divergence.

Leading companies with scale advantages can reduce procurement costs through long-term contracts, while leveraging technological barriers and strong customer loyalty to pass on price increases.

At the same time, their R&D capabilities enable rapid deployment of alternatives, such as aluminum-for-copper substitution and optical connectors, effectively hedging against cost risks.

Meanwhile, small and mid-sized manufacturers face a dilemma: severe product homogenization weakens their pricing power, allowing them to pass on only 30%–50% of cost increases, while gross margins are continuously squeezed.

Insufficient R&D investment also makes it difficult to overcome technological bottlenecks for alternatives, leaving them heavily dependent on traditional copper-based products.

The ability to manage costs has become a critical survival threshold, and the industry is accelerating toward a “stronger-get-stronger” structure.

From “Simply Absorbing Costs” to “Strategic Restructuring” How Can Connector Companies Break the Deadlock?

In fact, rising copper prices are not the first challenge the connector industry has faced.

What is different this time is that, with elevated copper prices likely to persist for the long term, companies’ strategies are shifting from short-term absorption to systematic restructuring.

1) Material Substitution: From an Alternative to a Mainstream Path

In the automotive connector sector, aluminum-for-copper substitution has become one of the most practical avenues for cost reduction.

Previously, in an interview with TE Connectivity by International Wire & Connector, it was noted that their low-voltage aluminum wiring harnesses, utilizing copper-aluminum composite terminals, effectively mitigate contact reliability issues caused by electrochemical corrosion and creep.

Combined with low-voltage aluminum core current-carrying wire technology, this solution can theoretically achieve up to 50% weight reduction and 50% cost savings on wiring materials.

Under large-scale application, it is projected to reduce copper usage in China’s automotive industry by approximately 300,000 tons per year, while cutting carbon emissions by around 850,000 tons.

However, from a system-level perspective, aluminum-for-copper substitution is not a “zero-cost replacement.”

In 48V vehicle architectures, while significant cost reductions can be achieved in the wiring harness itself, the entire vehicle requires systemic upgrades, such as motor EMC optimization and connector safety-level enhancements, resulting in substantial upfront investment. This creates a practical adoption barrier, where localized cost savings cannot fully offset broader system-level expenditures.

Nonetheless, industry practice shows that as new energy vehicle platforms become more standardized and scaled, aluminum-for-copper substitution is gradually moving from pilot projects to mainstream adoption.

2) Technological Substitution: Optical Connectivity Penetrating Traditional Copper Interconnects

In data centers and high-speed interconnect applications, another substitution path is rapidly emerging—optical connectivity replacing certain copper interconnect scenarios.

While short-distance board-to-board transmissions within traditional servers have largely relied on copper cabling, signal attenuation increases significantly over distances at 100Gbps and above.

In contrast, optical fiber exhibits much lower signal attenuation, and its material cost is unaffected by copper price fluctuations.

With declining optical module costs and improved reliability, optical technology is gradually penetrating short-distance interconnect applications that were previously dominated by copper.

In practice, companies are accelerating optical adoption.

InnoLight Technology has stated that optical modules can continuously upgrade with bandwidth demands and gradually expand into copper interconnect scenarios via silicon photonics technology. Its 800G OSFP optical module series has already seen widespread deployment in data centers and cloud networks.

Similarly, Luxshare Precision is accelerating its presence in the high-end optical module segment. Its 1.6T OSFP DR8 optical module adopts a silicon-photonic hybrid integration architecture, achieving per-channel rates exceeding 200Gbps, while its 800G OSFP optical modules have passed testing at leading AI compute centers and reached mass production delivery.

Over a longer term, the shift from copper to optical is not a complete replacement but a structural penetration, with its marginal reduction effect on copper demand gradually becoming apparent.

3) Structural Upgrades: From “Competing on Materials” to “Competing on System Capabilities”

Beyond material and technological pathways, a more fundamental change lies in the industry logic itself.

The normalization of elevated copper prices has thoroughly disrupted the traditional “scale-for-cost” competition model, shifting the core competitive advantage of connector companies from single-material control to full-chain system capabilities.

Survival strategies relying solely on bulk procurement discounts or passively compressing margins are no longer sustainable.

Companies must rebuild multi-dimensional capabilities to establish anti-cyclical barriers.

Product upgradation has become a key lever, with a focus on high-value applications such as aerospace and advanced industrial control, where technological iteration enhances product premium.

At the same time, system-level solutions are increasingly critical for customer retention, shifting from single connector supply to integrated “product + design + testing + operations” services.

By deeply embedding into downstream supply chains, companies can transform cost pass-through into value co-creation, significantly strengthening pricing power.

Supply chain coordination and lean operations are equally indispensable.

Leading companies stabilize raw material supply through long-term contracts or joint ventures with upstream and downstream partners, or reduce intermediate losses via vertical integration of core components.

Combined with automated production and digital management optimization, these measures further hedge against cost pressures.

At its core, the challenge posed by rising copper prices is not a matter of short-term “saving copper” tactics, but the depth and speed with which companies transform from material-dependent operations to technology-driven, system-empowered models.

This transformation represents the fundamental resilience required to navigate industry cycles.

Conclusion: Copper Prices Are Not the Endpoint, but a Watershed

Looking back on 2025, the significance of copper prices has long transcended the raw material itself.

They represent not only a concentration of global resource constraints, but also a key trigger for the connector industry’s deepening divergence.

For companies, copper prices cannot be “solved”, only “absorbed and managed”.

Those that successfully withstand this round of cost shocks are often not the fastest-reacting enterprises, but those with the most stable structures and clearest strategic pathways.

Against the backdrop of elevated copper prices becoming the new normal, the next phase of competition in the connector industry has quietly begun.