Under the drive of 5G communication, new energy vehicles, and AI computing power, the connector industry is experiencing a shift from “quantity” to “quality.”

According to SkyQuest data, the global connector market size is expected to surpass $90 billion (USD) in 2024, with China holding a 31% share, making it the largest single market.

How will domestic connector companies perform in 2024? What is the current state of downstream markets such as consumer electronics, automotive, communications, energy storage, and industrial control? What new growth drivers will emerge in the industry’s future?

To address these questions, International Cable and Connector has conducted a comprehensive analysis of the annual reports from 30 listed connector companies in China. The goal is to decode the trends of the industry’s high-end development and the key opportunities for domestic substitution from the financial data and business strategies.

P1

16 out of the 30 companies saw both revenue and profit growth:

The connector industry is on an upward trajectory, with the Matthew Effect intensifying.

In 2024, driven by demand in sectors such as new energy, communications, and consumer electronics, the connector industry is showing a typical structural characteristic of “stable growth for leading players, polarization among small and medium-sized enterprises, and pressure on the tail end.”

According to data from International Cable and Connector on 30 listed companies, the industry as a whole remains dynamic. Leading companies are consolidating their advantages through diversified strategies, while emerging players in niche markets are accelerating their rise. However, some companies relying on traditional business models or affected by policy fluctuations are facing growth bottlenecks.

Looking at the overall scale, 16 out of the 30 listed connector companies have achieved both revenue and profit growth, which confirms the resilience of the industry’s fundamentals.

According to the table, these companies had an average revenue growth rate of 21.61%. Among them, 7 companies—Electric Connector Technology, Recodeal, Dingtong Precision, Yonggui Electrical, Zuch Technology, Chuangyitong, and Everwin Precision—exceeded the average growth rate, with a focus on sectors such as automotive, communications, and consumer electronics.

Specifically, Electric Connector Technology, Recodeal, and Dingtong Precision saw their revenue growth approach 50% due to their strong presence in the automotive and communications markets.

Electric Connector Technology’s automotive connector business grew by 77.42%.

Recodeal expanded its market share by leveraging the rising penetration of new energy vehicles, and its U.S. factory’s stable operations boosted sales.

Dingtong Precision benefited from the growing demand in the communications connector market and new product mass production, leading to both increased orders and profits.

In the consumer electronics sector, Zuch Technology achieved a rapid growth rate of 31.77%, supported by stable demand in the white goods connector market, and is continuously increasing investment in its second major business—automotive connectors.

Even large leading companies like Everwin Precision performed well, surpassing the average growth rate with a 23.40% increase, driven by the new energy and consumer electronics markets.

In contrast, companies below the average growth rate showed varying degrees of slowdown, such as AVIC Optoelectronics, Shenglan Co., and Kaizhong Precision. These companies are either heavily reliant on traditional businesses or impacted by short-term fluctuations in demand from clients in sectors like defense and automotive, which has suppressed their growth.

It’s worth noting that despite Luxshare Precision’s growth rate being below the average, it still maintains its position as the industry leader with a revenue of 37.59 billion USD. Its automotive, consumer electronics, and communications businesses each saw a revenue growth of over 20%.

Meanwhile, companies like Deren Electronics, Aerospace Electrical, Quick Contact, Shaanxi Huada, Fushida, and Sunrise Elc Technology, which experienced revenue declines, have faced significant structural pressure due to adjustments and demand fluctuations in sectors such as defense and photovoltaics.

From the perspective of net profit, over half of the companies saw growth in net profit, with an average increase of 59.56%, further amplifying the industry’s divergence.

In this regard, companies such as Everwin Precision, Wutong Holdings, Kaizhong Precision, Kingsignal Technology, Chuangyitong Technology, and Electric Connector Technology performed exceptionally well, outperforming the average profit growth rate.

Among them, Everwin Precision stood out with a remarkable 2750.7% growth in net profit after deducting non-recurring items. Its high gross margin of 19.88% in precision structural components for consumer electronics, coupled with the scale effect from its new energy component business, led to a significant leap in performance.

Electric Connector Technology, Dingtong Precision, Wutong Holdings, and other companies achieved high growth in both revenue and net profit, reflecting efficient cost control and precise choices in automotive, communications, and other sectors.

Moreover, driven by the boom in new energy vehicles, rail transportation, and other sectors, companies like Recodeal, Yonggui Electrical, and Yihua Connector successfully turned losses into profits, demonstrating the strong profit-driving effect of high-growth sectors.

Overall, the growth drivers in the connector industry in 2024 are still concentrated in markets such as new energy vehicles, AI communication, and the high-end segment of consumer electronics.

With the global acceleration of intelligent and electrification processes, the industry’s concentration is expected to further increase. The technological iteration in high-end markets and domestic substitution will become the core competitive focus in the future.

Based on this, we will further analyze the 16 companies that achieved both revenue and profit growth, focusing on five major application areas: consumer electronics, new energy vehicles, communications, photovoltaics/energy storage, and industrial sectors.

P2

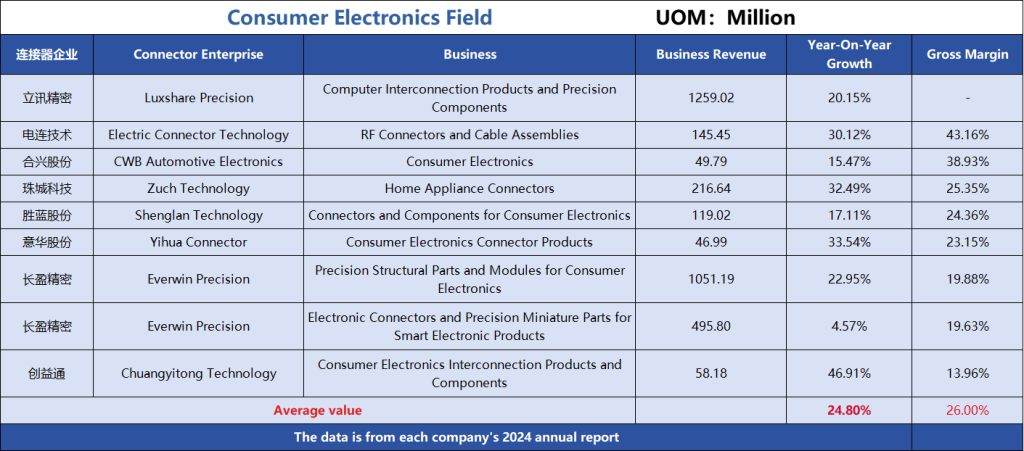

Consumer Electronics:

AI drives high-end development, while emerging markets stimulate incremental growth in connectors.

Under the dual influence of a moderate recovery in the global consumer electronics market and the AI hardware revolution, the connector industry is undergoing deep technological iterations and market restructuring.

According to IDC and Canalys data, the growth rate of traditional consumer electronics shipments in 2024 has narrowed to below 7%. However, high-end innovative categories such as foldable smartphones and AI wearables are rising strongly, driving the connector market to accelerate its upgrade toward miniaturization and higher integration.

According to the table, among the 16 companies with both revenue and profit growth, 9 companies in the consumer electronics sector achieved nearly 90% with double-digit revenue growth.

Among them, Electric Connector Technology, Zuch Technology, Chuangyitong Technology, and Yihua Connector saw growth rates exceeding 30%. Everwin Precision experienced a significant effect from international client orders, with its consumer electronics business revenue reaching 1.63 billion USD, a 15.39% year-on-year increase.

However, We observed in the annual reports of 30 companies that the trend of segmentation is intensifying.

Traditional consumer electronics markets such as smartphones and computers are showing weak growth. A typical example is Laimu Co., where revenue from mobile phone precision connectors and laptop connectors has declined, reflecting the saturation of low-end markets and intensifying competition.

Against this backdrop, domestic companies are accelerating their shift from complete assembly to breakthroughs in high-barrier core component fields, gradually breaking the dominance of international manufacturers and creating historical opportunities for local advanced manufacturers.

This transformation trend is also reflected in the gross margin performance: the industry average gross margin in the consumer electronics sector is 25.22%, with Electric Connector Technology, Hexing Co., and Zuch Technology surpassing the average.

The main growth drivers for these companies are concentrated in high-end sectors such as RF connectors, consumer electronics, and home appliance connectors.

Specifically, driven by the continuous trend of terminal products becoming thinner and multifunctional, the market has created significant growth opportunities for RF connectors and high-speed data transmission connectors.

For example, Electric Connector Technology has gained an advantage through technological upgrades, with its RF connectors and component products achieving a 30.12% year-on-year revenue growth and a gross margin of 43.16%.

Meanwhile, 5G and AI technologies are driving the smart home industry into a new growth phase. Zuch Technology has been deeply involved in the white goods sector, benefiting from both domestic and international sales. Its home appliance business saw a 32.49% year-on-year revenue growth, with a gross margin of 25.35%.

Overall, the global consumer electronics market is gradually recovering, driven by AI technology applications, the maturation of foldable screen technology, and growing demand for high-end products. The “trade-in” policy and collaboration within the smart home industry supply chain are injecting new momentum for growth in 2025.

P3

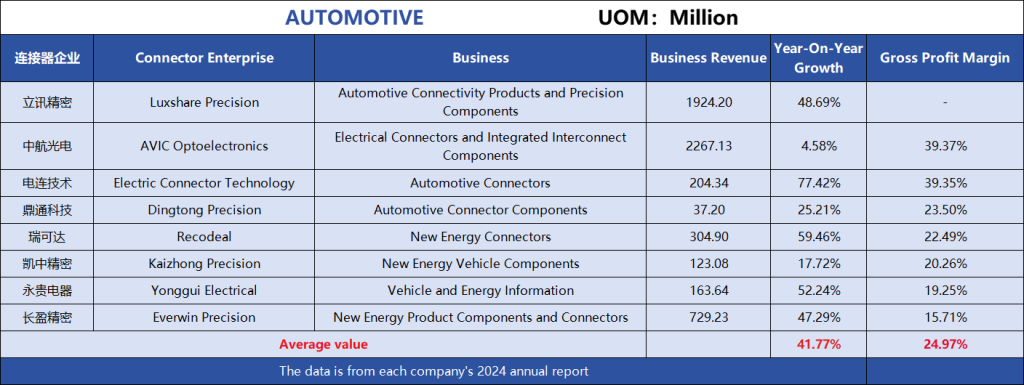

Automotive Sector:

The explosive growth of emerging markets and cost reduction across the supply chain are driving technological upgrades.

In 2024, the global automotive industry is accelerating its transition to electrification and intelligence. In China, the total sales of new energy vehicles reached 12.866 million units, with a market penetration rate surpassing 40.9%, driving structural opportunities in the connector market.

Compared to gasoline vehicles, the value of connectors for new energy passenger cars ranges from 420 to 700 USD per vehicle, more than three times higher than that for gasoline cars. For commercial vehicles, the value exceeds 1200 to 1400 USD per vehicle. The demand for high voltage and intelligent systems is driving the explosive growth of the industry’s incremental market.

According to the table, 8 companies with both revenue and profit growth in the automotive sector saw an average revenue growth rate of 41.77%. Among them, Luxshare Precision, Electric Connector Technology, Recodeal, Yonggui Electrical, and Everwin Precision all achieved growth rates above the average.

Notably, Luxshare Precision, a leader in consumer electronics, has maintained approximately 50% revenue growth in the automotive sector for three consecutive years through continuous acquisitions and R&D investments in the field.

From a gross margin perspective, the industry average is 24.94%, with only AVIC Optoelectronics and Electric Connector Technology surpassing the average level.

Electric Connector Technology has steadily increased its supply share with leading Tier 1 customers both domestically and internationally, achieving 0.204 billion USD in automotive connector revenue, with a gross margin of 39.35%.

AVIC Optoelectronics continues to strengthen its advantage in automotive high-voltage interconnects while expanding its business into intelligent connectivity and Busbar systems.

Additionally, further observation reveals that Dingtong Precision, Yonggui Electrical, and Kaizhong Precision have shown an upward trend in gross margins.

Current technological advancements are driving changes in the market landscape: With the widespread adoption of 800V/1000V high-voltage platforms, upgrades in 48V electrical architectures, and the implementation of Level 3 autonomous driving, companies like Luxshare Precision, Electric Connector Technology, AVIC Optoelectronics, and Yonggui Electrical are intensifying their focus on key technologies such as high-voltage connectors, liquid-cooled ultra-fast charging, aluminum replacing copper in low-voltage wiring harnesses, and 48V connectors. These companies are accelerating their efforts to compete for high-end market share with international giants.

Overall, the technological leap in the automotive sector and domestic substitution are jointly creating a trillion-dollar market space, with promising prospects in the new energy vehicle connector field.

However, in the context of the industry’s overall focus on cost reduction and efficiency improvement, how companies can achieve greater growth in both volume and price will be key to long-term development.

P4

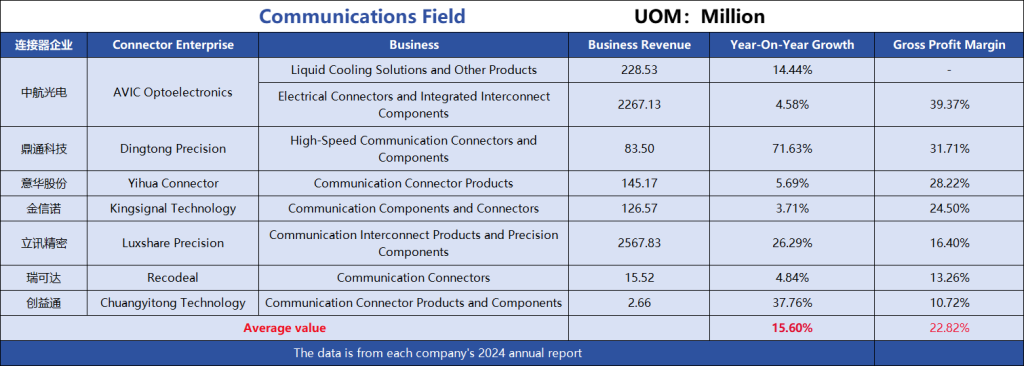

Communication Field:

AI computing power breakthroughs and accelerated domestic substitution

According to Bishop & Associates’ forecast, the global communication connector market will reach $21.5 billion by 2025, with China accounting for approximately $9.5 billion.

Driven by the explosion in AI computing power demand and the upgrading of communication networks, the high-speed connector market is entering a period of rapid growth. Technological iterations and architectural changes, such as 224G/448G high-speed transmission, liquid cooling, high-speed copper cables, and optical modules, are reshaping the industry landscape.

In 2024, the communication connector market showed a positive trend.

Among the listed companies involved in the communication business, over 60% achieved revenue growth across all communication sectors, with only two companies experiencing a decline in communication business revenue. The overall situation is better than in 2023.

According to the annual report analysis, the average gross margin in the connector communication sector is 22.82%, showing a pattern of industry profit differentiation. AVIC Optoelectronics, Dingtong Precision, Yihua Connector, and Kingsignal Technology all exceeded the average gross margin.

Dingtong Precision benefited from the demand in AI data centers and the mass production of 112G products, achieving both revenue and profit growth in high-speed communication connectors, with a gross margin of 31.71%.

AVIC Optoelectronics achieved a gross margin of 39.37% in electrical connectors and integrated interconnect components, continuing to focus on data centers, 5G base stations, and other related applications.

Kingsignal Technology provides internal and external wire end products, board-mounted connectors, and other products for data centers. The gross margin for communication components and connectors increased to 24.50%.

Yihua Connector has focused on high-speed communication connectors, concentrating on the R&D and manufacturing of 5G, 6G, and optical communication modules, with a gross margin approaching 30%.

It’s worth noting that despite a decline in revenue, Chuangyitong Technology’s data storage interconnection products and Shaanxi Huada’s low-frequency/RF connectors still maintained a gross margin of over 40%.

From a product technology trend perspective, copper connectors dominate short-distance high-speed interconnects in data centers, while optical connections like silicon photonics (SiPho) and LPO are driving optical modules to upgrade to 1.6T. High-speed interconnect products are growing alongside the expansion of computing infrastructure.

AI is raising the requirements for connector signal density, integrity, and heat dissipation, which in turn is driving demand for high-speed I/O, memory modules, and backplane connectors.

In summary, as the pace of domestic production increases for communication equipment manufacturers, opportunities for purely domestic connector manufacturers to enter the server market are increasing. New spaces for domestic substitution are emerging in high-speed backplanes, RF connectors, liquid cooling, and other markets.

P5

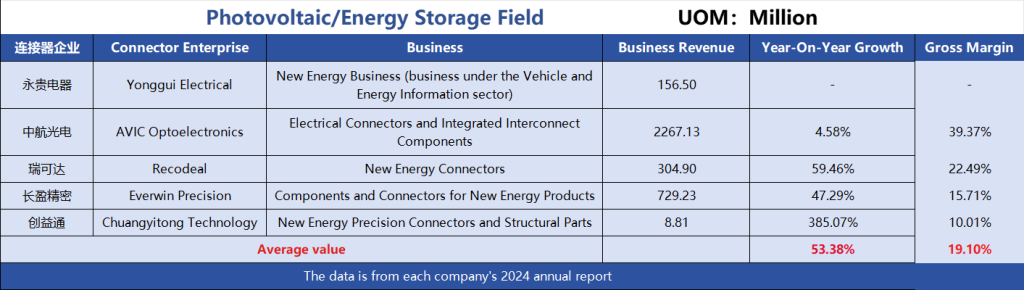

New Energy Field:

The energy storage sector continues its high growth, while the photovoltaic segment faces pressure and seeks transformation.

In 2024, the national installed capacity of new energy storage reached 73.76 million kilowatts, a year-on-year growth of 130%, driving explosive growth in the energy storage connector market. However, photovoltaic connectors have been dragged down by overcapacity in the photovoltaic industry, leading to a price war. As a result, the industry is facing a situation of “high growth in energy storage, but pressure in photovoltaics.”

According to the table, the average gross margin for the photovoltaic/energy storage connector industry is 19.10%. Among them, AVIC Optoelectronics and Recodeal exceeded the average, with connector companies involved in new energy storage businesses achieving varying degrees of revenue growth.

Specifically, Recodeal‘s new energy business revenue reached 0.3 billion USD, with a year-on-year growth rate of nearly 60%. Its gross margin of 22.49% remains at an upper-middle level.

At the same time, some companies have experienced explosive growth:

Chuangyitong Technology‘s new energy business revenue increased by 385.07%, nearly quadrupling year-on-year, with its gross margin rising to over 10%.

Laimu Co., while its energy storage revenue was only 1 million USD, saw a doubling of its revenue and a continuous improvement in gross margin, highlighting its growth potential in this area.

However, in the photovoltaic sector, connector companies are clearly under pressure.

Quick Contact has been affected by overcapacity and product homogenization, with its photovoltaic connector revenue falling from 30.2 million USD to 27.55 million USD, and its gross margin declining to 24.41%. Despite still ranking among the industry leaders, this highlights the intensifying competition.

Overall, energy storage connectors are experiencing high growth due to the resonance of policy and demand, while the photovoltaic sector must rely on technological innovation to withstand cyclical fluctuations.

With the deepening implementation of China’s “carbon peak and carbon neutrality” policies, solar power, wind energy, and energy storage continue to be the mainstream areas of development in today’s era.

P6

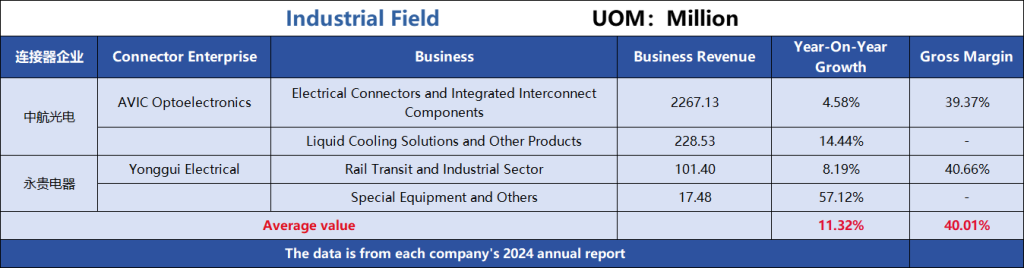

Industrial Sector:

The transformation toward industrial intelligence is driving diverse opportunities for connectors.

The wave of Industry 4.0 is driving a deep transformation in industrial manufacturing toward intelligence, automation, and digitization. Traditional sectors such as military defense equipment, aerospace, and rail transportation are accelerating their smart transformation. Emerging fields like humanoid robots and low-altitude flight are injecting new development opportunities into the high-end manufacturing industry chain.

In the military defense sector, the market size for Chinese military connectors surpassed 1.39 billion USD in 2022, and Yidu Data predicts it will reach 3.3 billion USD by 2026. The informatization of equipment is driving connectors to upgrade toward integration, modularization, and miniaturization.

AVIC Optoelectronics continues to solidify its position as a preferred supplier in the defense sector, with its electrical connector product revenue reaching 2.26 billion USDin 2024, a year-on-year growth of 4.58%.

In the aerospace and rail transportation sectors, the demand for high-end civilian markets is gradually unlocking its growth potential. AVIC Optoelectronics has officially launched its civil aircraft and industrial interconnect industrial park, accelerating its layout in the civil aircraft market.

Yonggui Electrical saw a significant 57.12% growth in its special equipment business revenue. Its rail transportation and industrial segments achieved 101.4 million USD in revenue, with an 8.19% year-on-year increase, and its gross margin rose to 40.66%.

In addition, companies like Luxshare Precision, Everwin Precision, and Recodeal have made strategic moves to enter the booming AI robotics market.

Everwin Precision’s 2024 financial report shows that its robotics and smart equipment business generated revenue of 4.07 million USD, a 42.07% year-on-year decline. This is due to the current market being in a window period, with mass production scales yet to materialize, and the effects of early investments still not evident.

With the intelligent transformation of the industrial connector market and the drive from emerging demands, the industry is exhibiting a “stable military, breakthrough in civilian, and emerging sectors gathering momentum” pattern. Manufacturers are focusing on high-end scenario technological breakthroughs and deepening domestic substitution.

Summary

In 2024, while the connector industry remains prosperous, underlying structural contradictions are becoming evident: The high-end market is still dominated by international giants, and although domestic companies are accelerating domestic substitution, the mid-to-low-end market is facing excessive competition. Meanwhile, they are also grappling with downstream demand fluctuations, intensified competition, as well as risks from gross margin and raw material price fluctuations.

However, from an application perspective, the trends of high-end development, intelligence, and domestic substitution are significant:

AI is driving high-end growth in consumer electronics.Electrification and intelligence in the automotive sector are activating demand.AI computing power is driving upgrades in communication connectors. The energy storage market is experiencing explosive growth. The industrial sector presents diverse opportunities.

The continued expansion of demand from emerging markets is driving the industry toward deeper technological breakthroughs. In the future, as domestic companies increase R&D efforts in areas like high-speed transmission and liquid cooling, coupled with breakthroughs in global client certifications, the process of domestic substitution is expected to transition from “partial penetration” to “comprehensive benchmarking.

China’s connector industry is set to build a new competitive landscape characterized by “domestic technology leadership, high-end market